As you’re probably aware by now, Facebook is an extremely effective tool for advertising and reaching new customers. Mortgage brokers can use this to their advantage by targeting homeowners, buyers, and renters.

When looking into investing your money into online marketing channels, don’t sleep on Facebook. As a mortgage broker, you should be devoting a good chunk of your budget towards Facebook ads.

With 2.74 monthly active users, Facebook gives you huge reach. It’s not a stretch to believe that at some point, a lot of those users will be in need of a mortgage broker.

What’s more – the average user spends 34 minutes a day on Facebook. Combine this with Facebook’s capable ability to hyper-target specific audiences quickly and efficiently, and you’ve got a great online marketing strategy on your hands – especially for mortgage brokers in particular. In this article, we’ll teach you how to make sure your ads appear for users.

Read on for some of our best tips for mortgage brokers, complete with some great examples and actionable pointers. And, as always, reach out to the team here at K6 with any questions you have. We know Facebook ads inside and out, and we can’t wait to help you see some killer results.

Facebook Ads: Some Basics

Let’s start off with a few of the basics – just in case you’re new to Facebook Ads or want a quick refresher.

Before you start generating leads and seeing results from your Facebook ads, it’s super important to understand how they work.

Your Facebook Ads will appear in different places across the platform, for example:

- Facebook Newsfeed

- Instagram Newsfeed

- Facebook Marketplace

- Video Feeds

- Right-hand column

- Facebook Messenger inbox

The majority of ads are shown on the Facebook Newsfeed.

Facebook ads are great for lots of reasons. According to Facebook, they’re especially helpful if you’re looking to:

- Promote your page/business

- Boost posts, videos, and events

- Promote call-to-acton buttons (especially good for generating leads)

- Increase website visitors

- Promote an app

- Get more leads

- And more!

For mortgage brokers, Facebook ads are great for increasing the traffic to your website, generating leads (through call-to-actions and more), and to promote your page/business.

Getting Started

Creating an ad from your Facebook Page is relatively easy. You’ll also have lots of creative freedom and control over the features of your ad.

- Ad creative: You choose the imagery, video, text, and call-to-action buttons you’d like to include in your ads. Mortgage brokers can use this space to create call-to-action buttons that generate leads and direct users to specific landing pages.

- Audience: You can choose the target audience for your ads. Create an audience based on gender, age, interest, location, and more. Additionally, Facebook will suggest ways to reach a larger audience. Facebook will also improve your audience details.

- Budget: You can select a budget that’s entirely up to you. Facebook offers suggestions, however, you’ll have the option to choose a custom amount. Some types of ads do require a minimum budget, but Facebook will identify those ones when you’re choosing your ads.

- Duration: Set the duration of your ads for as long as you’d like. You have the option to choose a set duration, such as 7 days or 30 days, or you can choose a custom end date for your ads.

- Placement: You can also select where you want your ads to appear. Facebook recommends that you select your ad to appears in all ad placements (this is called Automatic Placements), but you can also pick and choose where you want it to appear. For example, you can unselect Instagram and Messenger if you don’t want your ads to appear there.

Promote Your Business

Boost Post Button

Some of your Facebook Page posts may include a Boost Post button. This is a blue button that essentially converts an existing post into an ad.

Once you’ve boosted a post, it will appear as an ad in the same placements that traditional Facebook ads appear in. You can also select the audience, however, and customize the post in many of the same ways that you can for traditional ads. This is a great way to boost engagement through your ads and create brand awareness.

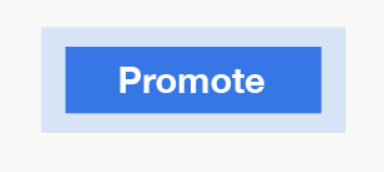

Promote Button

On your Facebook Page, you’ll notice a Promote button. Use this button to create ads based on particular business goals. This option is a great one for generating leads – so mortgage brokers, listen up!

If you use the Promote button, Facebook will compile information from your Page and help you create successful ads. It does this by mixing your Page’s information with your business goal that you’ve specified and identifying the best ways to advertise.

Ads Manager

You can also use Ads Manager if you feel like you want even more control over the creation of your ads. Ads Manager features all the tools you need to create ads. You’ll have complete control over all aspects of the ad creation process, as well as where they’ll appear and their duration. Advanced features included in the Ads Manager include custom audience creation, Facebook pixel creation, testing, access to all placements – and more!

In addition, you can also manage your payments, billing history, and spending limits. You can make copies of your ads, ad sets, and campaigns if you’d like to do that, too. Other great features include result analytics and custom graphs and tables that include customized metrics.

A Quick Note on Budgets

Before we move on to our top tips for mortgage brokers, we wanted to give you a quick rundown of how budgets work on Facebook Ads.

With Facebook Ads, you’re in complete control of your budget. Based on your budget and set duration, Facebook will spend evenly across that.

Facebook lists two different ways to control your spending:

- Daily budgets: You can select the average amount you want to spend per day across the duration of your ad.

- Lifetime/total budgets: You can choose a total overall budget that you’re willing to spend for the whole duration of your ad.

Your ads will enter an auction system, where Facebook works off of your budget. You’ll pay per number of clicks and number of impressions. Facebook gives you the option of choosing automatic or manual payments, and you’ll be able to view all of your charges in the Billing section of the Ads Manager.

How Mortgage Brokers Can See Success With Facebook Ads

Now, let’s get into the good stuff. As a mortgage broker, it’s important to get the most out of Facebook Ads, as it can make or break your online marketing strategy.

1. Use Targeted Ads

Ad targeting is a great feature on Facebook Ads, and it’s something you should definitely be using as a mortgage broker. You can target your ads specifically to groups of people who have an interest in housing or mortgages or by their location.

Facebook Ads feature some very specific targeting filters. For example, you can narrow it down to only recent university graduates if you want, or target people in certain tax brackets. This way, you can create highly personalized and tailored ads that speak directly to the people you want to reach.

Facebook allows you to do a lot with demographic information and mortgage brokers can use this to their advantage. Location, Age, and Detailed Targeting can help you narrow down your audience.

- Location: Select only your country/region, province/state, or local area to zone in on potential customers. Choose People who live in this location to ensure that those people will see the ads you create.

- Age: This is a helpful option if you’re hoping to target a certain age group. For example, you can choose mid-twenties to thirties if you want to target first time home buyers.

- Detailed Targeting: There are tons of options for detailed targeting that are helpful for all different kinds of ads. Under Demographics and Behaviours, the best options for mortgage brokers include:

- Demographics: Financial -> Income

- Demographics: Financial -> Net Worth

- Behaviours: Financial -> Investments -> Real estate investments

- Demographics: Home -> *All choices*

- Demographics: Life Events -> Newly engaged

- Behaviours: Purchase behaviour -> Home and garden -> Home renovation

- Demographics: Life Events -> Newlywed

- Behaviours: Residential Profiles -> Likely to move

- Demographics: Work -> Industries -> *All choices*

Some A/B tests may be in order so that you can determine what works best for each audience, but the hard work will pay off. Additionally, you can save multiple customized audiences so that you can select different ads to run for each one.

3. Consider Your Goals

When you’re creating your Facebook ad, you’ll need to have a goal to enter. For mortgage brokers, we always recommend choosing Lead Generation as your goal type. This is because the main goal of most mortgage brokers is to get potential customers to leave their information or chat with someone directly. Page likes, shares, and bookmarks are great, but they aren’t the main goal here.

Choosing Lead Generation as your goal will prompt potential customers with an easy to fill out lead generating form for them to enter their contact information. It costs a bit more to choose this option, but it pays off in the end.

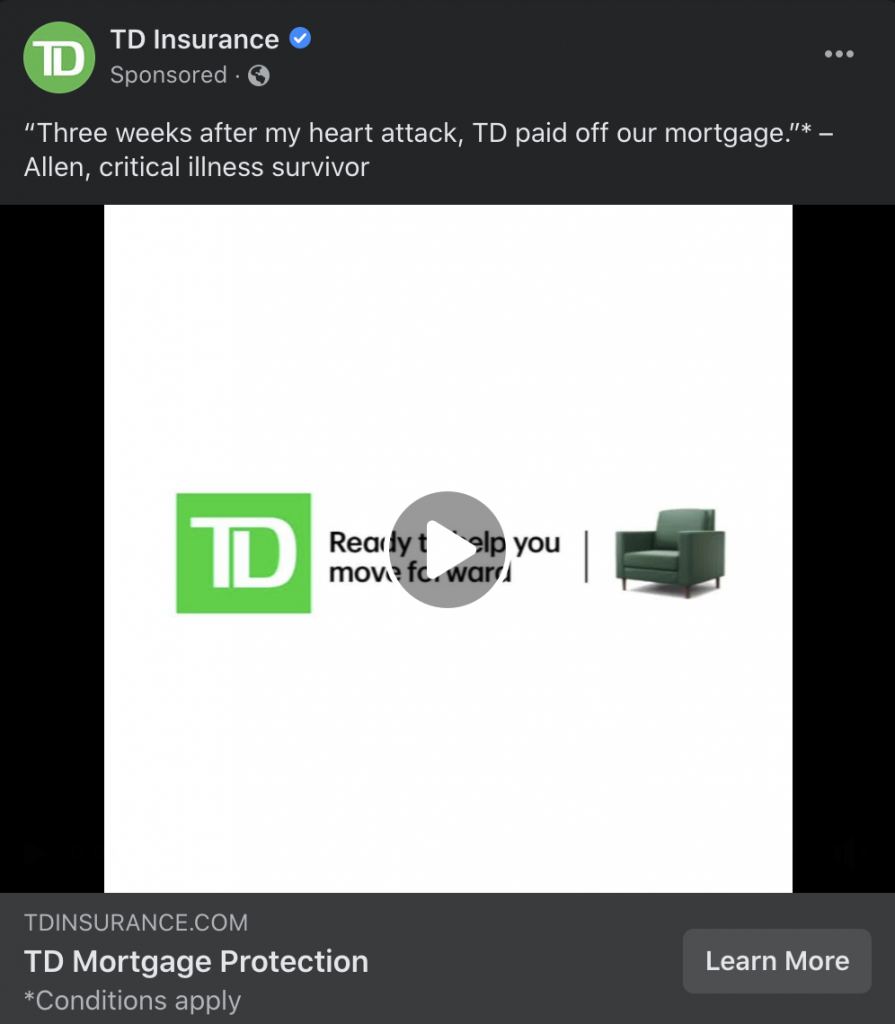

4. Take Advantage of Call-to-Action Buttons

Call-to-action buttons are an amazing way to generate leads, and Facebook Ads, as a platform, lends itself wonderfully to creating ads featuring call-to-action buttons.

The end goal of Facebook Ads are ultimately conversions, so using call-to-action buttons is one of the most direct ways to do this. Mortgage brokers can use them to direct potential customers to specially designed landing pages, contact information forms, application forms, and more.

If you’re stuck on what kind of button to use, a good one to use would be More Info or Learn More type of button. You can use the button to direct users to a form where you can collect contact information, such as names and emails so that you can contact them with additional information.

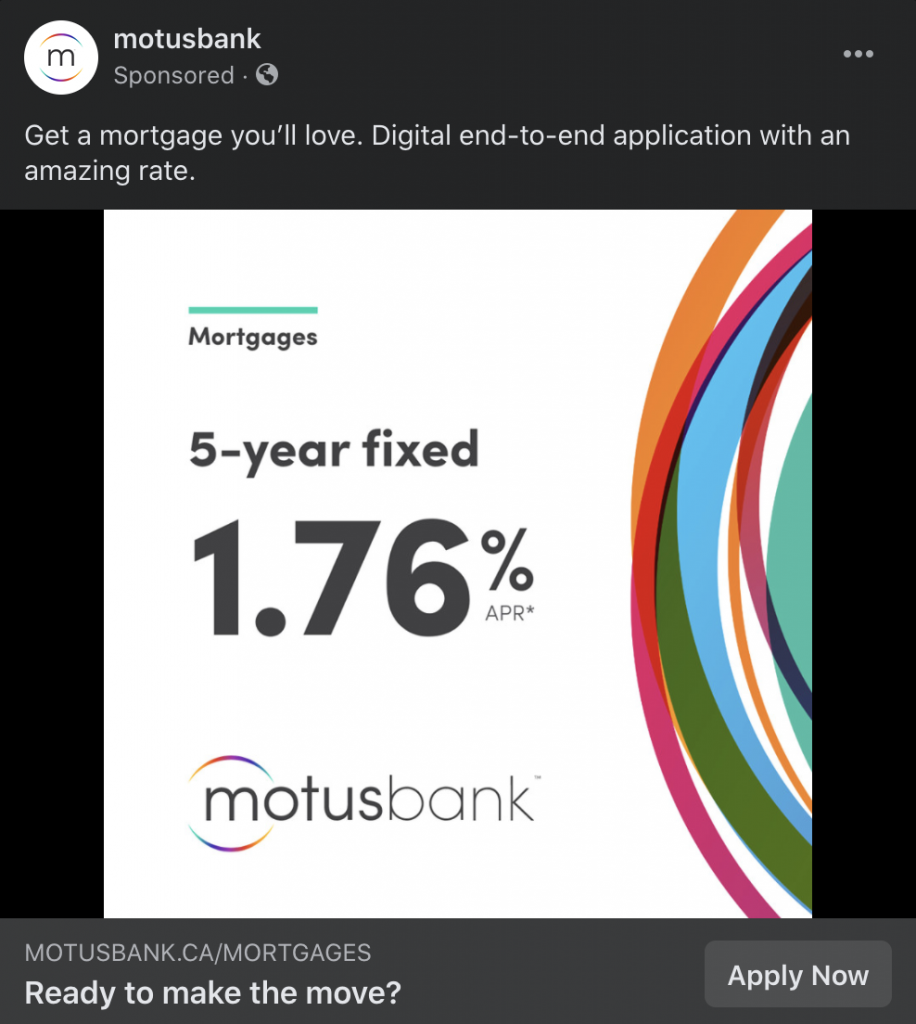

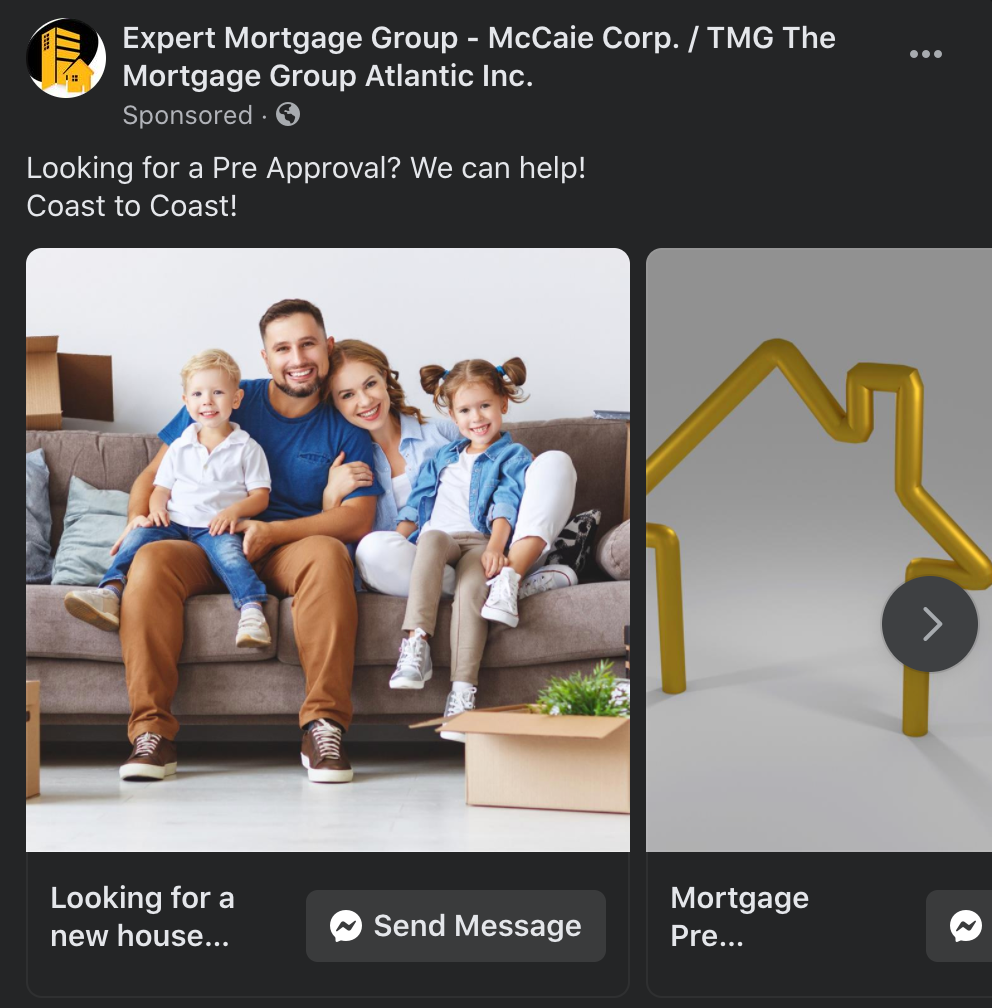

5. Images Win

You’re always going to see more success with an ad that uses images as opposed to only text. This is because as humans, our brains process images over 60 thousand times faster than text. With emotional images, users will be more drawn towards a specific action that you aim to evoke with the emotional image.

It’s pretty simple to do – if you want users to feel happy, use a happy image. Additionally, images with faces tend to do well because we respond to the emotion in a human face. We often make decisions based on emotions and we tend to look to a human face to gauge the appropriate emotion for the situation.

Images featuring people that users can identify with are also a great idea, just like the Expert Mortgage Group example above. It’s an excellent way to show that how your business fits into that lifestyle. Once people have identified with your brand, they’ll be more likely to choose it when it comes time for them to find a mortgage broker.

The great thing about Facebook Ads is that you can include more than one image as well. If you have a few images you’d like to use, try out the carousel feature. If you’re not sure what image to choose from but you want to create a single ad image, you can also run a split test to decide which image brings in a bigger response.

6. Facebook Desktop placement

This is a quick tip, but one we didn’t want to skip over because it makes a difference. Most people focus on mobile placements for their ads because they assume that people are on mobile. And for good reason – because 81% of people access Facebook only on their mobile phones.

However, it’s super important that you don’t sleep on Desktop placement. Mobile phones are great for people on the go, but when someone sits down at a computer, they’re often much more likely to be focused and driven to take action from a Facebook ad.

7. Limit Overexposure of Your Ads

Have you ever seen the same ad come up so many times that you just think I’m so annoyed by this ad!? Well, it happens to everyone and that’s why it’s so important to adjust the frequency rules on your ad. If you don’t, customers might decide to go with another, less annoying group of mortgage brokers.

Don’t worry, controlling your ad settings is easy. First, you’ll have to set a condition on your ad. Choose Frequency and is greater than X. Next, you’ll set your action to Turn off ad sets. It’s that simple!

Of course, you want them to see it more than once (we’ll go over that more in the following tip), but it’s one thing to see an ad 3 or 4 times… and quite another thing to see it 9 or 10 times.

8. Facebook Ad Analytics

Make sure to monitor your performance on Facebook Ads. After you’ve run a campaign, you’ll want to look at the results. The information you can get from the results of your campaigns will help you to run better future campaigns. After a few campaigns are under your belt, you can compare campaigns and determine what elements your of ads perform best.

A lot of people ignore their results and because of that, are running campaigns that make the same mistakes over and over again.

9. Target, Then Retarget

Just as you don’t click on every ad the first time you see it, you can’t expect that people will click on your ad the first time they see it. In fact, quite often when users do click on your ad, it’s after the second or third time they’ve seen it. This can be for a variety of reasons, but a lot of the time it’s because people just don’t have time or got lost scrolling through a sea of other ads and content.

For this reason, setting up a retargeting campaign is a really smart idea.

When setting up your campaign, you can choose from 5 retargeting options:

- Viewed/Added to Cart – Not Purchased: You can select to promote specific products or services that people have viewed or added to their cart but did not buy.

- Added to Cart – Not Purchased: Similarly, this option is useful for abandoned carts.

- Upsell Products: This is a good option to target customers who have viewed a product with an add on or different version of the product.

- Cross-Sell Products: Based on what customers have viewed from your product set, promote other products.

- Custom: This option works well to promote products to a Custom Audience of your choosing. Use exclusions and inclusions to select audience interactions for your retargeting campaign.

For mortgage brokers in particular, we recommend going with a Custom campaign. Mortgage brokers can use Facebook ads to hyper-target audiences, so a hyper-targeted retargeting campaign will ensure that ads will be featured on the right potential customers’ news feeds. Just as you would use inclusions and exclusions to target your ads the first time, use them to retarget your ads, too.

10. Ad Copy Matters

While images are really important in a Facebook ad, you can’t ignore the ad copy. It’s true that the image does a lot of the heavy lifting in the ad, but if you don’t have good ad copy, it doesn’t matter how good your image is.

There are a few different elements of your ad copy that you need to pay attention to. You’ll want to make sure that you’re communicating to potential audiences that your services as a mortgage broker will make their lives easier.

You can include words that will trigger emotional responses – for example, you could say something along the lines of “feel good in your new home…” to elicit a good feeling.

11. Test Your Facebook Ads

Mortgage brokers can test the elements of their ads right on Facebook. It’s always helpful to do this so that you can see what works and what doesn’t. You can test tons of things – such as ad copy, headlines, and different call-to-action buttons.

Testing ads might sound more complicated than it actually is, but it’s actually quite easy. Have fun with it and compare the results of each different ad you test. The data you collect from your testing will give you some valuable insights into what your audience is looking for in your ads.

If you’re not confident with your own testing abilities, we can help you out. The team here at K6 are experts at testing ads. We’ve been doing it for years and can help you get the most out of your online marketing strategy.

Next Steps For Mortgage Brokers

Now that you’ve read our best tips, it’s time to apply them to your own ad strategy. As a mortgage broker, you can use Facebook Ads in a unique way with detailed targeting filters. And, what better place to test out your ads than on one of the biggest websites in the world?

We hope this article gave you some great insight into how to create amazing Facebook Ads for mortgage brokers. We’re always here if you need any help running you Facebook Ads campaign, so please reach out!