The United States offers remarkable opportunities for businesses around the world. It has the largest economy and continues to be the leading destination for imported goods, making it an attractive market for brands of all sizes.

The rise of eCommerce has opened the door even wider, allowing companies to reach customers across borders with far less friction. Entering the US market can be exciting, especially for growing online brands and first-time importers. The potential to expand your product range and scale your business is significant, yet the process also comes with regulations and compliance steps that require careful attention.

This guide walks you through the essential stages of entering the US import market. You will learn the key regulations that affect international shipments and discover how to avoid paperwork mistakes that can slow your progress. With the right preparation, your plan to expand into the United States can become a successful reality.

Understand the Basics of U.S. Ecommerce Entry

Your success in importing starts with a clear understanding of what you’re bringing into the United States. You can save time, money and avoid headaches by getting these three basics right before shipping your first product.

Know what products you’re selling and their classifications

Your import strategy needs accurate product classification at its core. The US customs requires proper identification for every item coming in. The right classification tells you the duty rates and shows if your product meets government agency requirements. Getting it wrong can cost you big – penalties can reach up to 4 times the lost revenue or 40% of the dutiable value each time.

Products change, legal views shift, and new rulings pop up over time – all this affects how items get classified. Regular classification checks can spot issues early, helping you cut costs and stay out of trouble with enforcement.

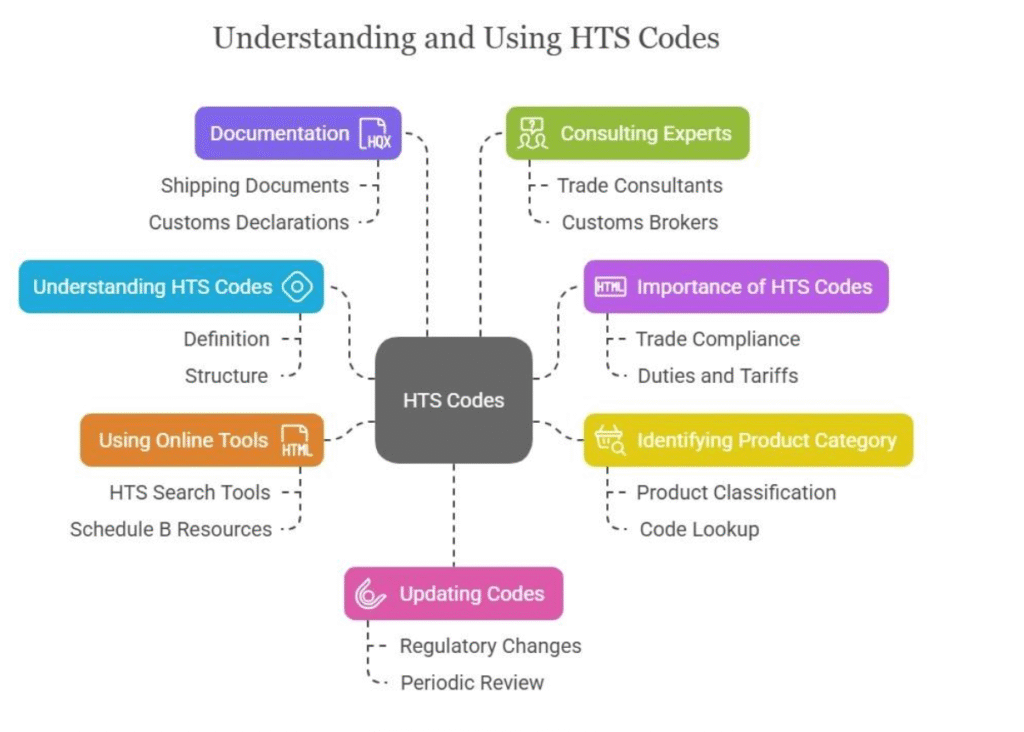

Understand the Harmonized Tariff Schedule (HTS)

The Harmonized Tariff Schedule of the United States (HTS) sets tariff rates for everything coming into the country. The World Customs Organization created this system that has about 5,000 commodity groups. Each group has its own six-digit code.

The HTS works like a standard naming system. While the first six digits are the same worldwide, the US adds extra digits to be more specific. Finding your product’s HTS code helps you figure out your tariff and tax rates. The U.S. Census Bureau’s Schedule B Search Engine can help, or you can call their analysts at 1-800-549-0595.

Know the typical import fees to US

Your bottom line depends on several types of import fees, and these costs can vary widely depending on the country of origin. Many new sellers research topics such as import fees from Japan to US to understand how different markets affect overall expenses. The most common charges you should prepare for include:

- Import duties: These depend on what you ship, its value, material, or where it’s from

- Import taxes: The government sets these percentage rates, like Value-Added Tax

- Tariffs: These taxes protect local industries and bring in revenue for the government

- Merchandise Processing Fee (MPF): US Customs and Border Protection bases this on your goods’ value

Many new importers get shocked when they see their first duty and processing fee bills. That’s why getting your HTS classification right matters – it determines your duty rate and shows if you can use special import programs.

Set Up the Right Support and Documentation

Success in the US market depends on proper documentation and expert guidance. The paperwork for international shipping can feel overwhelming. Becoming skilled at this process is vital for smooth customs clearance.

Why working with a customs broker helps

Most ecommerce businesses find that partnering with a customs broker is more than helpful—it’s a necessity. These licensed professionals act as intermediaries between you and US Customs authorities. Their specialized knowledge helps prevent mistakes that can get pricey. Customs brokers keep up with changing regulations, handle documentation, and make sure your shipments meet all relevant laws.

A broker can spot duty-free opportunities and tariff classifications to reduce your import costs. Even with a broker’s help, note that you cannot delegate responsibility. The legal obligation for compliance stays with you as the importer.

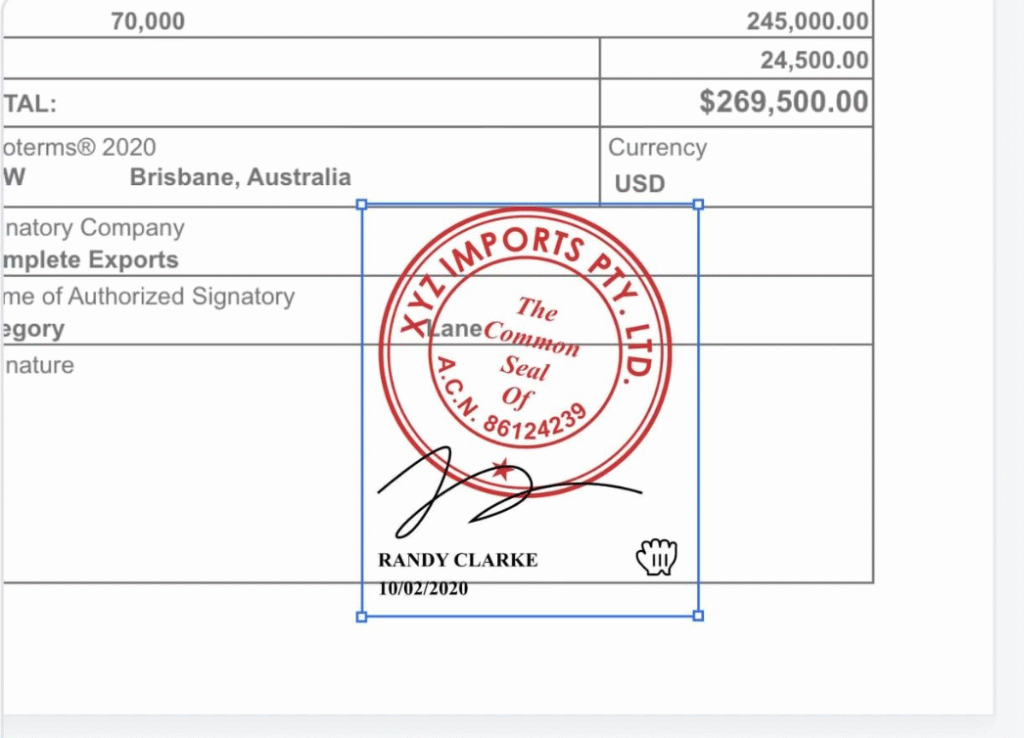

Essential documents for your first shipment

US shipments need specific documentation. Incorrect or missing paperwork causes most import delays. You’ll need these key items:

- Commercial Invoice: The most important document for ocean freight shipping, containing financial details between shipper and receiver

- Bill of Lading: Legal evidence of the shipping contract that also serves as title to the goods

- Customs Bond: Required for commercial goods valued above $2,500, guaranteeing compliance with regulations

- Packing List: Detailed overview of packed items that speeds up customs inspection

- Importer Security Filing (ISF): Must be submitted 24 hours before vessel loading to avoid penalties

Avoiding delays with proper paperwork

Your documents need meticulous accuracy beyond just having them ready. Additional examinations happen when inconsistencies appear between your packing list and bill of lading. Vague product descriptions often lead to extra fees and longer inspection times.

Clear product information should be available to customs agents. New importers should pay extra attention to documentation. Commercial invoices must include exact descriptions, quantities, values, HTS codes, and country of origin. Using Harmonized System codes for all products helps meet current standards, especially when you’re just starting out.

Start Small and Build a Scalable System

A gradual approach gives you room to learn, adjust, and limit risk as you enter the American market. Smaller steps help you understand how shipments move through the system and allow you to strengthen operations before you scale. Keep these priorities in mind as you build a dependable foundation:

- Begin with small shipments to learn the import process and become familiar with requirements such as Section 321 procedures and the Entry Type 86 program

- Develop strong relationships with reliable suppliers and use clear communication, shared demand forecasts, and consistent performance reviews to improve delivery speed and product quality

- Use dependable shipment tracking tools that offer real time updates, predictive information, and improved visibility across your supply chain, which also helps reduce customer inquiries about order status

Use Technology and Plan for Growth

Technology adoption makes entering the US market simpler. Digital tools provide practical solutions for new importers who need help with customs clearance and compliance management.

Use digital customs platforms effectively

Digital customs platforms automate your entry into US markets. Advanced systems connect through API or EDI and upload thousands of files within minutes. These platforms verify customs documents beforehand and show your shipments’ current status. You can work with any courier to get the best rates because many solutions are carrier-agnostic.

Track tariff changes and trade policies

US tariff changes have become crucial since November 2025. The United States added various reciprocal and sectoral tariffs after February 2025. Applied tariffs combine newer measures, older trade rules, and exemptions that often build upon each other. Customs intelligence tools provide up-to-the-minute updates on regulatory changes to help you stay informed.

Create SOPs and review compliance regularly

Standard Operating Procedures (SOPs) are the foundations of lasting success. Your SOPs should cover:

- Roles and responsibilities for trade compliance

- Supplier screening processes

- HS code classification procedures

- Documentation management

- Recordkeeping policies

Regular reviews of your compliance status and import history help identify ways to improve. These assessments keep your business aligned with changing regulations.

Final Thoughts for New Market Entrants

Stepping into the US ecommerce landscape requires careful planning, clear procedures, and consistent attention to regulatory details. Each stage of this process strengthens your ability to operate with confidence, from product classification to documentation and long-term compliance planning. As your understanding grows, so does your capacity to manage shipments with fewer disruptions and greater predictability.

Success in this market comes through steady progress rather than sudden leaps. Small wins build a dependable system that supports your expansion goals. With the right preparation and a commitment to learning, your business can navigate the complexity of US importing with clarity and control. This journey opens the door to a larger customer base, stronger supply chain strategies, and a future shaped around long-term growth.