Open API in Insurance

Analyzing the trends of the global insurance market, experts predict that soon no business will be able to cope with its tasks independently. More and more insurance companies depend on each other to form ecosystems. Together they use new technologies, services, distribution channels and other opportunities. Andersen fintech experts know everything about insurance services via the API: what benefits they provide and what operations can be carried out using them.

What does an open API mean

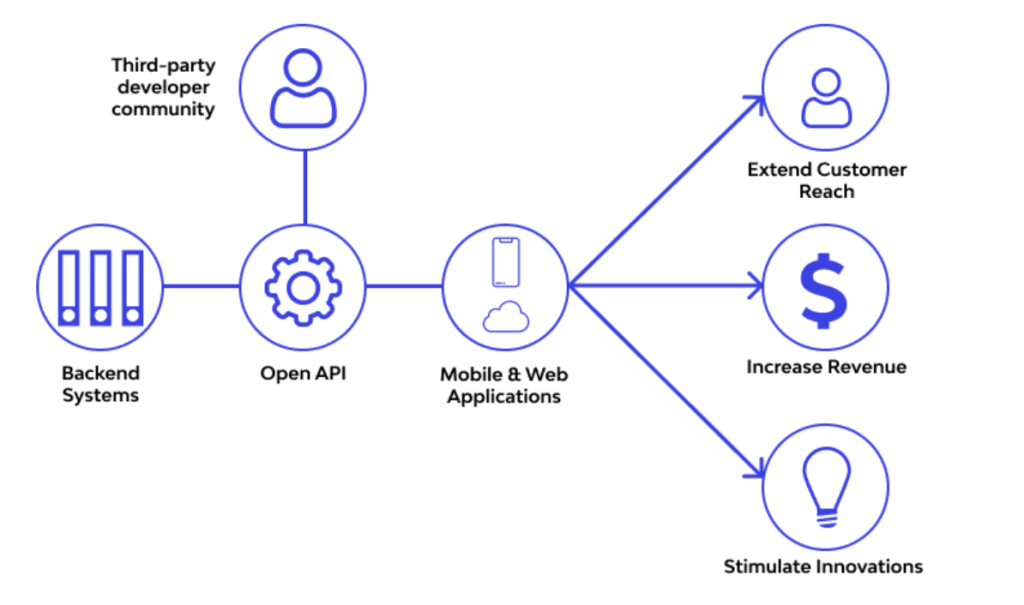

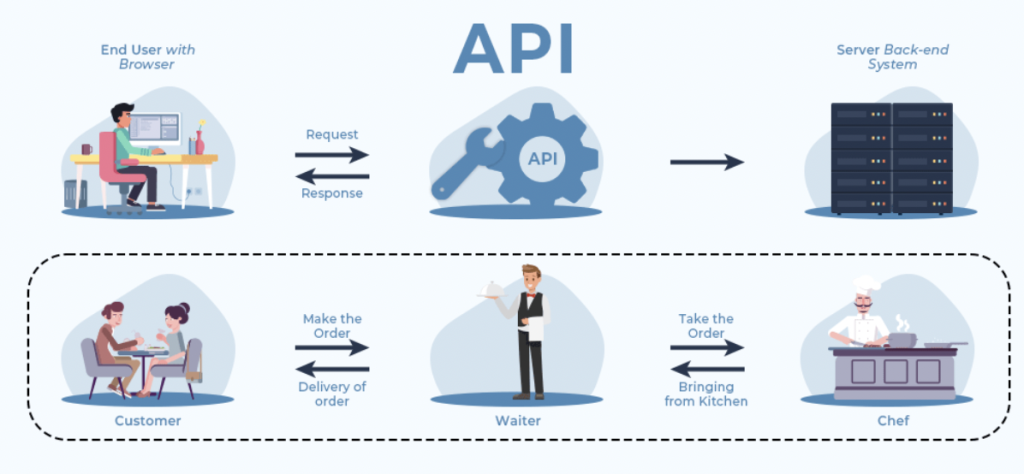

On the client side there is an open API interface, which can be freely accessed by any Internet user. From an engineering point of view, APIs are sets of requirements that define how one application can “interact” with another. Such APIs are usually hosted on open portals and can be combined with external partners. The open API simplifies registration and integration with insurance company platforms, as well as facilitates the connection of new applications and functions.

In the technology sector, open APIs have been discussed for a long time. A striking example is the Uber ecosystem. Here iOS (Android) is responsible for the technical part. Maps are provided by Google Maps, and the route is calculated by MapKit. Twilio, in turn, sends text messages to users. The payment goes through Braintree, and the voucher is sent through Mandrill. In addition, the resources are kept in the AWS cloud. As you can see, the combination of these API services has created a unique solution, thanks to which Uber is used by more than 93 million people worldwide.

Insurance is considered a conservative industry that is slowly implementing new solutions. As of 2019, only 21% of enterprises directly provided access to insurance services through the API (for comparison, at about the same time, 84% of financial companies invested in services with an open API).

The OPIN Innovation Lab found out that open APIs are most often used in the automotive sector (25%), in flight delay insurance (20%) and accident insurance (17%). Simple customized products dominate among all available APIs.

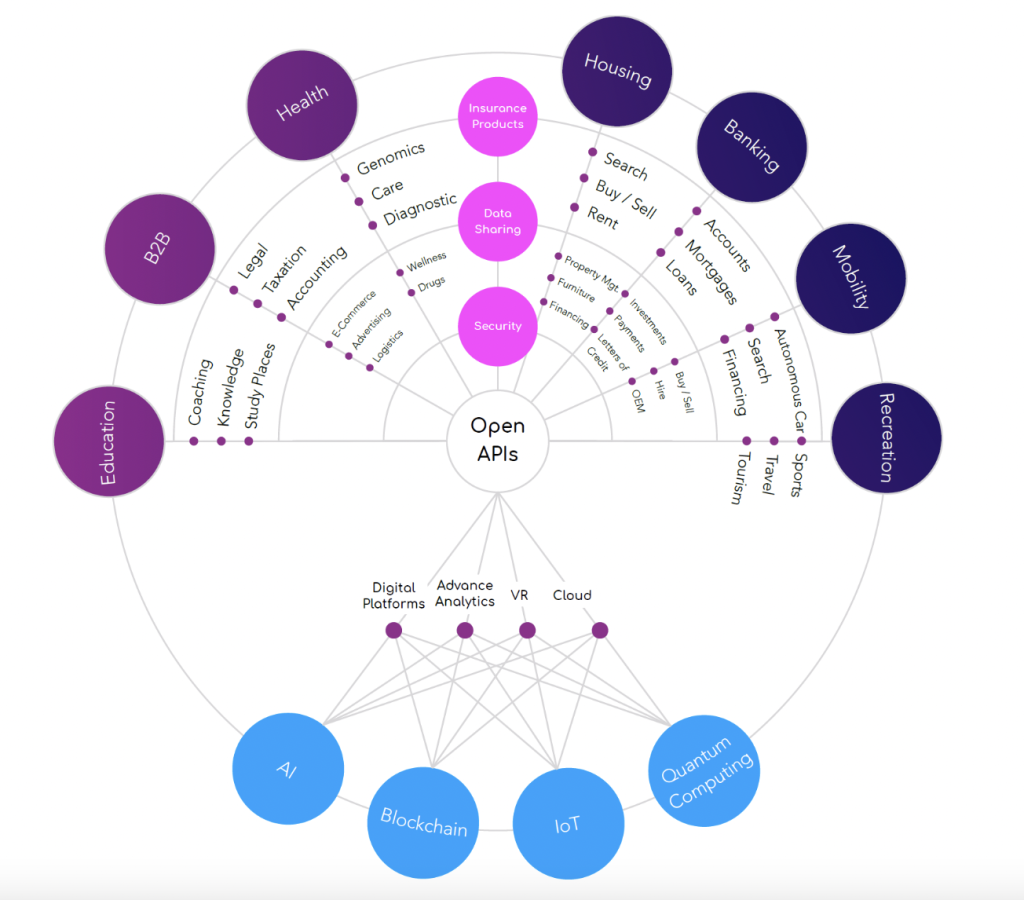

Open insurance is becoming a trend that helps to attract customers and stay ahead of competitors. Open software interfaces lead to the principle of “Insurance in Everything” when it becomes part of the proposals for smart homes, autonomous vehicles, online medicine and so on. Risk management is getting closer to becoming an organic part of everyday life.

In which cases do insurance companies need an API

Interest in open API insurance services did not arise from scratch. They became necessary for the following reasons:

- Instant and round-the-clock interaction with customers.

Companies should prepare for the fact that in the future insurance products will spread rapidly, and most of the processes will be automated. Customers demand round-the-clock, multi-channel and personalized service. They do not want to purchase a standard insurance package, but to receive an individual offer from the company. For example, to insure an expensive camera during a trip abroad. Therefore, insurance companies seek to increase the number of contact points with customers.

- Companies don’t have enough resources to innovate.

Innovation is not a cheap process, and if a company is engaged in digitalization, it becomes even more difficult to allocate resources to work with new services. Therefore, insurance companies resort to open APIs and are looking for partners.

- Advanced competitors appear.

Innovative companies offer services to customers faster and cheaper using chatbots or other systems based on artificial intelligence, machine learning and IoT. For example, insurance software solutions for cars can take into account the nature of trips (speed, type of braking or acceleration) determined using GPS. Based on this information, insurance companies analyze the risk of accidents and provide discounts to drivers who adhere to a safe driving style. To implement technological innovations at home, insurance companies create ecosystems with an open API.

- It is necessary to process large amounts of data.

Access to data is the key point of open insurance. In this industry, terabytes of customer information are generated daily. On the one hand, this creates a certain complexity, because, despite the growing volume of data, customers want to have quick access to services. So, the more information your company has about a client, the more accurately it predicts risks and forms an up-to-date offer.

Insurance organizations are interested in integration with partner companies in order to efficiently process the data flow and transform it into valuable business information. APIs connect all participants of the digital ecosystem through which data is transmitted. Partnering with specialized API development services streamlines the integration process. It helps create seamless data exchange and enhanced functionality within your digital ecosystem.

- API-based architecture is cheaper and simpler.

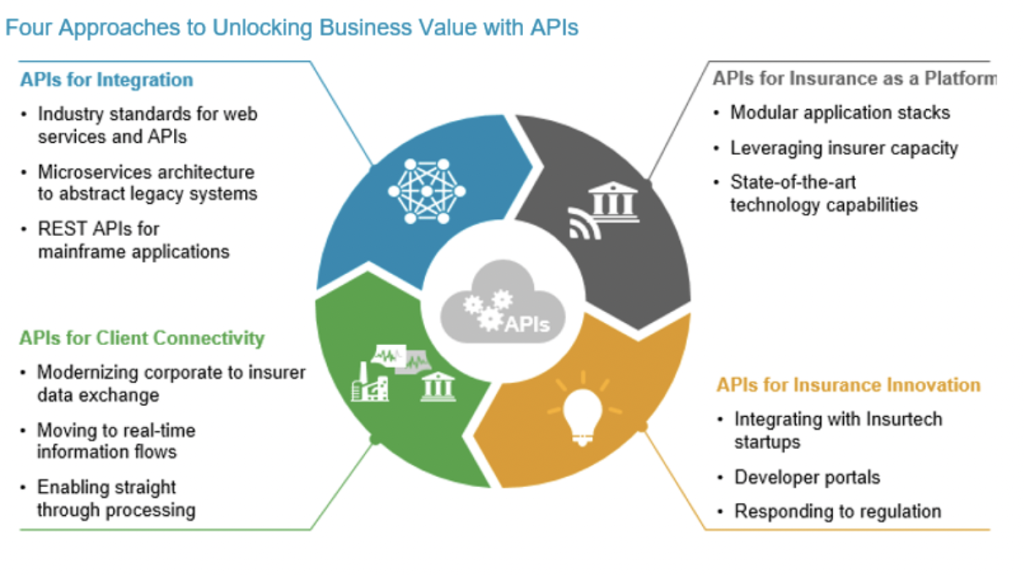

Conventional insurance programs are large, closed, integral legacy systems. But such frameworks are not suitable for the rapidly changing digital world: they are expensive, work slowly and cannot provide full integration. Therefore, insurance companies are gradually switching to an architecture based on microservices, where the main role is played by a fast, convenient and inexpensive API.

Insurance agencies create their own digital ecosystems or participate in external ones. Thus, they become open and offer insurance as a service (IaaS). The API ecosystem in this case resembles an application store with services from partner participants. The customer chooses the right offer and easily switches from one product to another.

What functions does the API offer to business

An open API gives companies advantages that the old business model lacks, namely:

- Use large amounts of insurance ecosystem data.

The insurance company, as a member of the ecosystem, receives data about customers in order to know about their preferences. This allows businesses to offer relevant services to clients. For example, thanks to open banking in the UK, customer account data is now available to third-party providers. Insurers can receive information about the financial condition of clients and about monetary transactions. In turn, companies analyze this data to offer an up-to-date insurance product.

Another example where data is important is home insurance. By offering a package of services, the company can include Internet of Things devices, such as: smart water meters, smoke detectors, alarm systems, etc. Thus, in the event of a gas leak, smoke or burglary, the emergency team will be able to warn the policyholder about the incident.

- Share data with other parties.

By collecting and analyzing data, insurance companies can share information with other interested parties. For example, it can be a risk assessment solution, a history of user complaints, reviews of customer assets or liabilities, and so on. Imagine if the usual green card of an insurance company is replaced with a digital analogue of the API, the police, ANPR cameras and inspection companies will be able to directly check all the details of the car insurance policy.

- Open your product package to the world.

Thanks to the open API ecosystem, companies can share their products, services and solutions with the whole world. By uniting with partners in a single network, insurers gain access to various sources to attract new customers and retain existing ones.

For example, if a partner company has a car rental application, you can integrate it with an accident insurance service. If any firm offers firewalls and antivirus scanners to customers, you can team up with it to sell cybersecurity insurance. There are many options for creating an ecosystem.

What should be an open API

It is important for managers to understand that an open API is not only a convenient technology, but also a commercial business product.

A successful open API must have the following properties:

- be monetized (commission for payment, paid advertising, percentage of partner companies, and so on),

- provide valuable services to clients,

- collect more data about users,

- be flexible and adapt to changing market conditions.

It is also necessary to have a strategy for using the API of partner companies. It allows you to quickly create new services and expand their capabilities.

The only difficulty on the way to an open API is the lack of its standardization. It is difficult for IT specialists to combine completely different APIs that a separate company wants to connect to. Many initiatives (OPIN, ACCORD, CGI, NAIK and others) strive to develop a single standard.

What you need to know about the open API before integration

In order for one program to exchange data with another (for example, the Uber application shows the customer’s location on a Google map), the API owner must publish the specification of the application programming interface. Here you need to specify information about the functionality, the method of data transmission and the format of their exchange, the way of API development, the data access standard, and so on.

Taking into account that the open API is publicly available, it is important to ensure data security. In addition, the API should be available around the clock, stay flexible and easy to deploy, as well as freely scale depending on the load on the resource.

APIs are usually supported by a “gateway” that performs the following functions:

- routes and prioritizes requests,

- allows the API to connect to mail servers, databases, etc.,

- manages security (API visibility, access, message authentication, attack prevention),

- manages the available APIs,

- supports API portal (subscription, documentation, sandbox description, etc.),

- provides tools for designing, creating, documenting, testing, and deploying APIs,

- responsible for API analytics (technical condition monitoring, SLA compliance, API traffic control, etc.),

- responsible for API monetization.

Conclusion

A properly built ecosystem of open APIs will make insurance products cheaper, as well as more accessible, personalized, intuitive, flexible and convenient for customers. When you are open to cooperation in such ecosystems, you can constantly add new services there.

If you need assistance in implementing insurance services innovations, feel free to contact Andersen. We will help you choose the best digital solution directly for your business.